|

Cost of Electricity & Air Emissions from Systems Part 1:

Reducing Greenhouse Gas Emissions

by William G. Acker

Share This Article

Reducing Greenhouse Gas Emissions and the Impact on U.S. Energy Prices. The international effort to halt global warming may send energy prices soaring.

Over the past 12 months,

crude-oil prices have surged

to the highest level since

the Persian Gulf War,

proving once again that we have very

little control over a critical cornerstone

of our economy: energy prices.

The oil embargo of 1973 led to long

lines at service stations, higher overall

energy prices, double-digit inflation,

and a general sense of panic. It's important

to remember that the latest shortage,

which tripled the price of a barrel

of oil, occurred because OPEC cut oil

production by only about 5 percent of

world demand.

|

Articles

|

The current international effort to

reduce greenhouse-gas emissions from

the burning of carbon fuels is going to

have a significant impact on the price of

energy in the U.S. and on our economy.

In 1998, the Energy Information Administration

(EIA) of the Dept. of Energy

released a study titled "Impacts of

the Kyoto Protocol on U.S. Energy Markets

and Economic Activity." The report

details five different scenarios, the

worse of which has coal prices increasing

by over 800 percent in 10 years compared

to a "reference case" which assumes

no changes in U.S. policy, law, or

taxation regarding the coal industry.

The EIA's worse-case scenario assumes

that two significant policy changes will

occur in the U.S. in next 10 years: Senate

ratification of the Kyoto Protocol, an

international agreement to reduce

greenhouse-gas emissions, as well as the

passage of a carbon tax, which is a fee designed

to strongly discourage the use of

fuels that produce CO2. The best-case

scenario in the same study has coal

prices increasing 152 percent by 2010.

If the Kyoto Protocol is ratified, the

EIA maintains that the U.S. could reduce greenhouse-gas emissions in other

ways, besides slashing coal use: for example,

international carbon trading

with other countries; developing

higher efficiency motors, as well as hybrid

motors, which consume less fuel;

and planting more trees.

While the EIA likes to discuss these

alternate means of cutting greenhouse

emissions, an analysis of U.S. fuel consumption

trends reveals that it would be

virtually impossible to achieve the reductions

set forth by Kyoto without penalizing

coal use.

The intent of this article is to provide

the reader with some insight into

future prices of coal, petroleum, natural

gas, and electricity through 2020, with

a focus on the possible outcome on fuel

prices resulting from a concentrated effort

to slash our carbon emissions.

Since energy is used to produce most

goods and services in this country,

higher energy prices are a major concern

to everyone. Decisions your company

makes today should reflect the reality

that energy prices are poised to

change dramatically due to the restructuring

of the U.S. electric-power industry

and the worldwide commitment to

reduce greenhouse-gas emissions. The

fact that coal prices may increase

somewhere in the range of 150 to 800

percent in the next decade should be a

consideration if your plant or facility,

for example, plans to install a new

coal-fired boiler in the near future.

Of course, reducing our use of coal

will increase our dependency on other

energy sources. What follows in this article

(Part 1 of a 2-part series) is an

analysis of our energy sources and what

the impact of both electric utility restructuring

and the Kyoto Protocol will

be on each of them.

U.S. Electric Power Industry The electric-power industry in the

United States is composed of traditional

electric utilities as well as power

marketers and non-utility power producers.

Currently, the industry is being

restructured so that the three primary

components of electric service—generation,

transmission, and distribution—

are separated. Instead of purchasing

power from the local utility,

consumers will be able to purchase

from other generators across the U.S.

Proposed legislation will deregulate the

generation part of the industry; however,

transmission and distribution

utilities will continue to be controlled

by state regulatory commissions. This

section of the article will review the

costs that makeup the total delivered

cost of electricity (Busbar cost) for

each generation system technology.

The author chose to review total costs

so that the data could be compared to

data from the EIA (1998 Electric

Power Annual, Vol. 1; 1997 Electric

Power Annual, Vol. 2; Financial

Statistics of Major U.S. Investorowned

Electric Utilities, 1996; Electric

Sales and Revenue, 1997; Emissions of

Greenhouse Gases in the U.S., 1998;

and Annual Energy Outlook 2000).

The electric-power industry in the

United States is composed of traditional

electric utilities as well as power

marketers and non-utility power producers.

Currently, the industry is being

restructured so that the three primary

components of electric service—generation,

transmission, and distribution—

are separated. Instead of purchasing

power from the local utility,

consumers will be able to purchase

from other generators across the U.S.

Proposed legislation will deregulate the

generation part of the industry; however,

transmission and distribution

utilities will continue to be controlled

by state regulatory commissions. This

section of the article will review the

costs that makeup the total delivered

cost of electricity (Busbar cost) for

each generation system technology.

The author chose to review total costs

so that the data could be compared to

data from the EIA (1998 Electric

Power Annual, Vol. 1; 1997 Electric

Power Annual, Vol. 2; Financial

Statistics of Major U.S. Investorowned

Electric Utilities, 1996; Electric

Sales and Revenue, 1997; Emissions of

Greenhouse Gases in the U.S., 1998;

and Annual Energy Outlook 2000).

Table 1 provides the electric utility

costs to produce, transmit and distribute

electricity to the customer with

existing generation systems. The primary

source of financial data in this

table comes from Federal Energy Regulatory

Commission (FERC) Form 1

manuals of low-cost utility providers.

The data were then compared to government

publications which summarize

the data taken from the utilities

FERC Form 1. The total Busbar cost or

revenue per KWH from these existing

systems tend to be lower because they

are older systems with low depreciation

and low long-term debt.

The average age of coal-fired systems

in the U.S. is approximately 41 years,

hydro is 54 years, oil steam is 31 years,

natural gas is 30 years and nuclear is 18

years. The gas-turbine system represented

in Table 1 would be a fairly young

plant. The prices are 1997 costs per KWH.

The low-cost producer in this table is hydroelectric

at 4.72 cents per KWH followed

by coal steam at 5.72 cents per

KWH. Due to limited resources, hydroelectric

power is not the predominant

technology in the U.S. It is coal steam,

which produces over 55 percent of our

electricity. Due to upcoming environmental

pressures, coal usage will decrease

over the next 20 years. The degree

to which it decreases is subject to

debate. According to the EIA's Annual

Energy Outlook, coal usage will continue

to increase, but lose market share

over the next two decades.

The average age of coal-fired systems

in the U.S. is approximately 41 years,

hydro is 54 years, oil steam is 31 years,

natural gas is 30 years and nuclear is 18

years. The gas-turbine system represented

in Table 1 would be a fairly young

plant. The prices are 1997 costs per KWH.

The low-cost producer in this table is hydroelectric

at 4.72 cents per KWH followed

by coal steam at 5.72 cents per

KWH. Due to limited resources, hydroelectric

power is not the predominant

technology in the U.S. It is coal steam,

which produces over 55 percent of our

electricity. Due to upcoming environmental

pressures, coal usage will decrease

over the next 20 years. The degree

to which it decreases is subject to

debate. According to the EIA's Annual

Energy Outlook, coal usage will continue

to increase, but lose market share

over the next two decades.

Table 2 is information taken from

the EIA's "Electric Power Annual." The average revenue in cents per KWH is

calculated by dividing the total revenue

by the corresponding KWH sales for each

sector (residential, commercial, industrial,

and other) and from all generation

technologies in that state. To compare

the Busbar cost of each technology, it

was important to look at states that had

high percentages of electricity generation

for that technology. The numbers

in the two tables seem to compare

rather favorably to Table 1 data except

for nuclear. After further review the author

did find somewhat high costs from

sales for resale that could be adding as

much as a cent per KWH. According to

data from the Nuclear Energy Institute

(NEI) on operations, maintenance and

fuel, there is a 1.6 cent/KWH variation

from low -cost plants to high-cost

plants. At this point, it is difficult to say

exactly how much of the added cost (2.8

to 3.50 cents per KWH) is from nuclear

plants and how much might be from

other technologies, sales for resale, and

outside contracts.

The average revenue in cents per KWH is

calculated by dividing the total revenue

by the corresponding KWH sales for each

sector (residential, commercial, industrial,

and other) and from all generation

technologies in that state. To compare

the Busbar cost of each technology, it

was important to look at states that had

high percentages of electricity generation

for that technology. The numbers

in the two tables seem to compare

rather favorably to Table 1 data except

for nuclear. After further review the author

did find somewhat high costs from

sales for resale that could be adding as

much as a cent per KWH. According to

data from the Nuclear Energy Institute

(NEI) on operations, maintenance and

fuel, there is a 1.6 cent/KWH variation

from low -cost plants to high-cost

plants. At this point, it is difficult to say

exactly how much of the added cost (2.8

to 3.50 cents per KWH) is from nuclear

plants and how much might be from

other technologies, sales for resale, and

outside contracts.

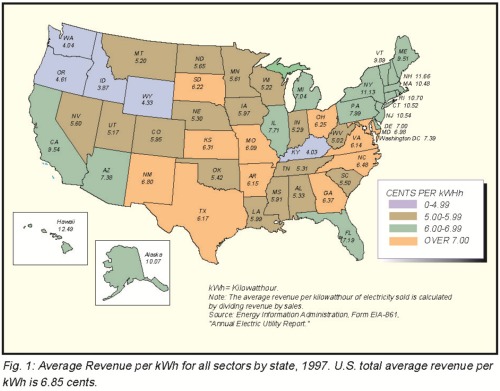

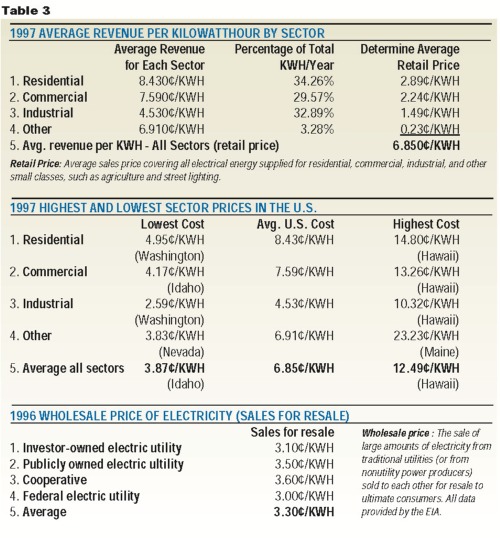

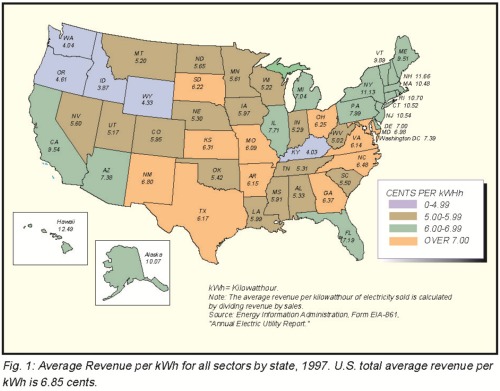

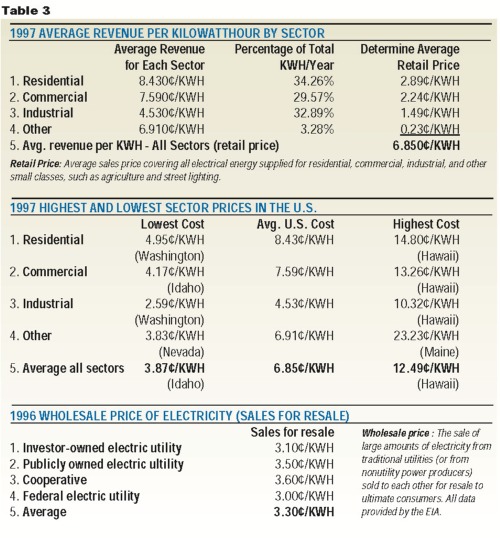

Figure 1 is a map of the U.S., which illustrates

the average revenue per KWH in

all sectors by state for 1997 (also called

retail price). These data were taken from

EIA Form EIA861 "Annual Electric

Utility Report". Table 3 provides a

breakdown of the average retail price

into an average price for residential,

commercial, industrial and other. This

table also provides the average 1996

price from each type of electric utility.

Many existing utility generation systems

in the United States are fairly old

and their construction costs already

have been recovered. For this reason, it

is important to look at the total revenue

costs for new capacity as well.

Table 4 illustrates the total revenue

operating costs for new electric utility

generating systems. For new capacity additions, the low capital cost and high

operating efficiencies of natural-gas,

combined-cycle gas turbine plants are

the most economical. The total revenue

(or operating costs) will be higher

in new capacity additions verses existing

capacity because of the capital recovery

costs. You will note that the

older, depreciated coal-steam generation

systems produce electricity at 5.62

cents per KWH (Table 1) versus a newly

installed natural gas combined cycle

turbine at 5.72 cents per KWH (Table

4). Therefore, a low-cost utility would

want to keep its older coal units running.

However, as electric demand increases,

requiring new construction,

the preferred system is a natural gas

combined cycle turbine.

Hydroelectric systems were not included

in Table 4 because, under current

circumstances, hydroelectric generating

capacity is expected to remain

virtually unchanged due to water use

priorities moving away from electricity

generation and toward environmental

improvement, such as fish, habitat

preservation, and recreation (EIA's

Annual Energy Outlook 2000).

Information from the EIA on utility

capacity additions also supports naturalgas

turbines as the choice system. From

1996 to 2010, combined-cycle gas-turbine

system installations are expected to

grow from 15,200 to 90,100 MW, a 493-

percent increase. Coal- steam systems,

however, will only increase from 303,700

MW to 307,800 MW, a 1.35 percent increase

(assuming no Kyoto Protocol).

Coal system electric generators will increase

their electricity output approximately

18 percent from existing systems

by increasing their average utilization

rate. Although, coal maintains its fuel

cost advantage over both oil and natural

gas, gas-fired generation is the most economical

choice for construction of new

power-generation units when capital,

operating and fuel costs are considered.

Another reason for the slow-down in

coal-fired installations may be the upcoming

environmental pressures. The

biggest challenge for coal fired utilities is

facing the regulatory uncertainty.

The impact of future compliance

costs to handle particulate, SO2, SO3,

lead, mercury, and arsenic eventually

will result in higher electricity costs from

coal-steam systems. The total operating

maintenance and capital recovery cost

of a flue gas desulfurization system is

around 0.5 cents per KWH. Each existing

coal-fired plant must weigh the impact

of compliance cost on the projected cost

of electricity in their region. The flue gas

emission discharge for each generation

technology in Table 5 illustrates the significantly

higher rates from coal steam

generation systems.

Coal-fired electric utilities in the U.S.

have made a lot of improvements over

the last 10 years to clean their flue gas

emissions, however, current environmental

pressures will require further improvements

which will result in higher

operating costs. If you compare coalfired

systems to conventional naturalgas

combined-cycle turbines (Table 5),

the lbs of CO2 per KWH from the coal system

is around 159-percent higher. If you

compare lbs of SO2 per KWH, the coal system

without an SO2 scrubber is approximately

240,000 times higher. With a

scrubber, it is 3300 times higher. Currently,

there are 1207 coal-fired generation

systems in the U.S. and only 193 systems

(19 percent) have SO2 scrubbers.

In summary, as individual states restructure

their electricity markets, increasing

numbers of customers will have

the opportunity to chose their electricity

suppliers resulting in lower electricity

prices for most. The 1998 plan issued by

the Clinton Administration said that

consumers would save $20 billion per

year under deregulation (0.55cents per

KWH), which apparently would save the

U.S. around 8 percent on the average retail

price of electricity. According to the

Annual Energy Outlook 2000, the average

price of electricity will decline (assuming

no Kyoto Protocol) from 6.7

cents per KWH in 1998 to 6.1 cents per

KWH in 2005, to 6 cents per KWH in 2010,

to 5.9 cents per KWH in 2015, and finally

to 5.8 cents per KWH in 2020. This represents

an average annual decline of 0.6

percent. According to the "Impacts of the

Kyoto Protocol on U.S. Energy Markets

and Economic Activity" report, this

translates into decreases for residential,

commercial, and industrial electricity

users of 10 percent, 17 percent and 14

percent, respectively, from 1998 to 2020.

Some states, however, are expected to experience

a price increase, such as Idaho,

which currently has low cost hydroelectric

power. In March 1999, the Agriculture

Dept. issued a report that listed 19

states expected to have higher electricity

prices. The states are in the Pacific

Northwest, Mountain States, Mid-

South, Northern Plains and in some

Great Lakes states. In Figure 1, states that

are very low- cost producers of electricity

may see their rates increase because under

deregulation these low-cost utilities will

have the opportunity to sell their power

to more expensive states (or regions) and

thus increase their profit margins.

Impacts of the Kyoto Protocol

As currently written, the Kyoto Protocol

requires the U.S. to reduce its carbon

emissions to 7 percent below 1990 levels.

In 1990, the six greenhouse-gas

emissions in the United States totaled

5,489,900,000 tons of gas. When each

gas is weighted by its global warming

potential, the total is 1,642,000,000

metric tons of carbon or carbon equivalent.

Of this total, the combustion of

energy fuels produced 5,440,267,390

tons of CO2 gas or 1,346,000,000 metric

tons of carbon which is 82 percent

of the total emissions. By 1998, the energy

related emissions increased to

6,003,290,605 tons of CO2 or

1,485,400,000 metric tons of carbon.

The greenhouse gases that absorb infrared

radiation (heat) are water vapor

(H2O), carbon dioxide (CO2) methane

(CH4), nitrous oxide (N2O), and a host

of engineered synthetic chemicals such

as Hydrofluorocarbons (HFCs), perfluorocarbons

(PFCs), and sulfur hexafluoride

(SF6). Water vapor is the most common

with an atmospheric concentration

of almost 1 percent, carbon dioxide is

0.0356 percent, methane is 0.00017 percent

and nitrous oxide is 0.000031 percent.

The greenhouse gases covered by

the Protocol are carbon dioxide,

methane, nitrous oxide, hydrofluorocarbons,

perfluorocarbons, and sulfur hexafluoride.

For the three synthetic greenhouse

gases, countries have the option of

using 1995 as the base year.

Basically, there are three ways that

the U.S. plans to reduce energy related

carbon emissions: cut the demand for

energy, use more efficient equipment,

or switch to less carbon-intensive fuels

(from coal to natural gas), or noncarbon

fuels.

Fossil fuels derive their energy content

primarily from oxidation of the

hydrogen and carbon in the fuels.

However, coal derives a higher percentage

of its energy content from the

oxidation of carbon than oil or natural

gas. This is illustrated in Table 5 under

CO2 (lbs per million BTU of fuel).

The CO2 formation from coal combustion

is around 76 percent higher than

natural gas and around 24 percent

higher than petroleum. As you can

see, the proposed Kyoto Protocol limitations

on carbon emissions will have

a significant impact on the coal industry,

the mining industry and the railroad

industry, all of which will trickle

down into dozens of other industries.

The impacts to fuel costs and the U.S.

economy from the international effort

to reduce greenhouse gas emissions

will be discussed in the second half of

this two-part series, which will appear

in the September, 2000 issue of HPAC

Engineering.

Cost of Electricity & Air Emissions from Systems Part 2:

Reducing Greenhouse Gas Emissions

by William G. Acker

The international effort to halt global

warming may send energy prices soaring

The Kyoto Protocol is the

name commonly used to describe

the agreement that

came from the "Third Session

of the Conference of the Parties to the

Framework Convention on Climate Change," which was held in Kyoto, Japan,

in December 1997. During that

meeting, representatives from more

than 160 countries met to negotiate

binding limits on greenhouse-gas emissions

for developed nations.

Change," which was held in Kyoto, Japan,

in December 1997. During that

meeting, representatives from more

than 160 countries met to negotiate

binding limits on greenhouse-gas emissions

for developed nations.

What Kyoto Demands

The Kyoto agreement established a

legally binding protocol under which

industrialized countries would reduce

their collective emissions of six greenhouse

gases—carbon dioxide, methane,

nitrous oxide, hydrofluorocarbons, perfluorocarbons,

and sulfur hexafluoride—

by 5.2 percent below their 1990

levels by the first commitment period,

which begins in 2008 and ends in 2012.

The target for the U.S. is 7 percent below

1990 levels. Because the Protocol

does not specify any targets beyond the

first commitment period, the target is

assumed to hold constant from 2013

through 2020. The participating developed

countries, or Annex I countries,

are the U.S., Eastern and Western Europe,

Russia, Ukraine, Japan, Australia,

New Zealand, and Canada. The 133

non-Annex I countries, which include

Mexico, India, China, and South Korea,

have no targets under the Protocol.

To become binding in the U.S. , the

Senate must approve the Protocol. So

far it has not been submitted to the Senate

for ratification.

To recap Part 1 of this series, there

are three ways that the U.S. can reduce

energy-related carbon emissions: cut the

demand for energy, use more efficient

equipment, and switch to less carbonintensive

fuels (from coal to natural gas)

or non-carbon fuels. Figure 1 shows the

usage of the three primary fuels (petroleum,

coal and natural gas) for both the

reference case, which assumes no Kyoto

Protocol, and the case of 7 percent below

1990 levels. By comparing the fuel

usages of the two cases, one can get a

sense of how the three ways to reduce

energy-related carbon emissions will

work.

In 1990, the six greenhouse-gas emissions

in the U.S. totaled 5,489,900,000

tons of gas. When each gas is weighed

by its global-warming potential, the total

is 1,642,000,000 metric tons of carbon

or carbon equivalent. Of this total,

the combustion of energy fuels produced

5,440,267,390 tons of CO2 gas or

1,346,000,000 metric tons of carbon,

which is 82 percent of the total emissions.

By 1998, energy-related emissions

increased to 6,003,290,605 tons of CO2

or 1,485,400,000 metric tons of carbon.

Figure 1 illustrates emissions from the

combustion of energy fuels from 1990

through 2020. There are two graphs

plotted on this chart: the reference case

graph and the 7-percent-below-1990

graph. The reference case graph represents

actual emissions from 1990

through 1998 and reference projections

from 1998 through 2020, assuming that

the Kyoto Protocol is not enforced. The

second graph, 7-percent-below-1990,

represents the projections of emissions

assuming the Protocol is approved by

the Senate and assuming that the target

of 7 percent below 1990 levels is met entirely

by reducing energy-related carbon

emissions with no offsets from sinks

(land use and forestry issues) and other

greenhouse gases or international activities.

This graph represents the worstcase

scenario in regard to the amount of

emissions reductions required to meet

the Kyoto Protocol goal and on the potential

impact on U.S. energy prices,

energy uses and the economy. The Energy

Information Administration's

(EIA's)analysis of the Kyoto Protocol

has five less stringent scenarios that may

or may not be the final goal of energyrelated

emissions.1 This article will only

focus on the reference case and the 7-

percent-below-1990 case.

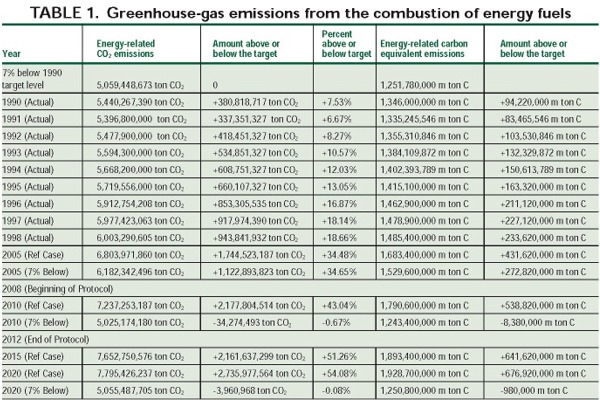

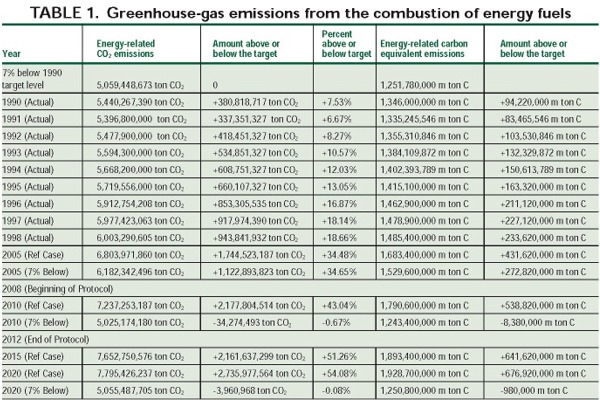

Table 1 provides the CO2-emissions

numbers used in the graph as well as

the metric tons of carbon equivalent. By 2010 (mid-year of the Kyoto commitment

period), the reference case

emissions are 43 percent above the 7-

percent-below 1990 emissions, which

is 2,177,804,514 tons of CO2 over the

target of 5,059,448,673 tons of CO2.

By 2010 (mid-year of the Kyoto commitment

period), the reference case

emissions are 43 percent above the 7-

percent-below 1990 emissions, which

is 2,177,804,514 tons of CO2 over the

target of 5,059,448,673 tons of CO2.

In the reference case, all fuels continue

to grow in demand but in the 7-

percent below 1990 case, petroleum and

coal usage drops and natural gas usage

increases. By 2020, coal consumption

drops dramatically to 71,000,000 tons

per year for the case of 7- percent-below-

1990, which is a 91-percent drop

from the usage in 2005. In comparison

to the reference case, coal consumption

is down by 94 percent. This major drop

in coal consumption is related to its

CO2 formation.

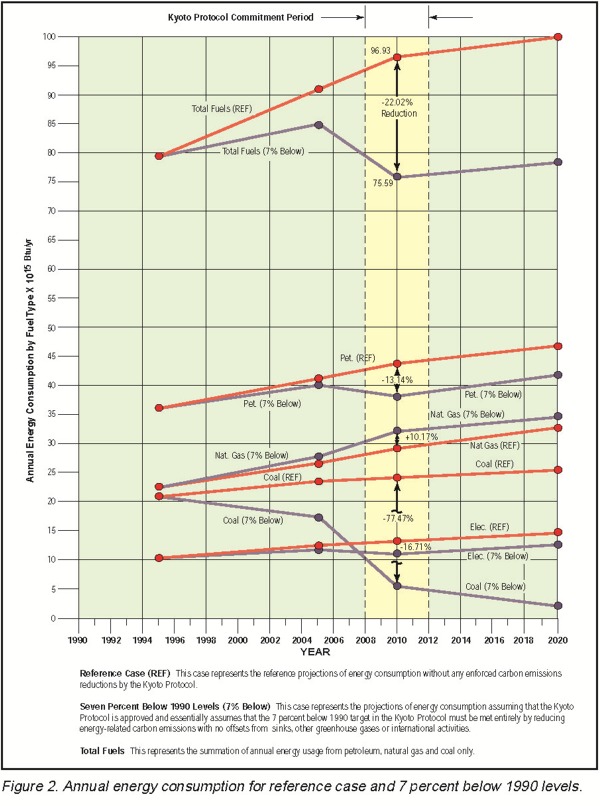

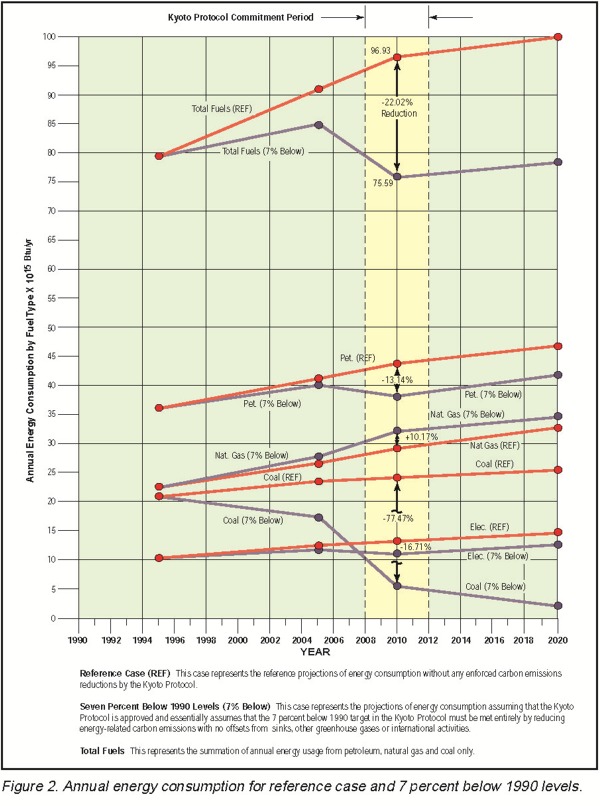

Figure 2 illustrates the changes in future fuel consumption for the reference

case and the 7-percent-below-1990

level (on a Btu basis). One also can

compare the differences in fuel consumption

from the reference case to the

case of 7-percent-below-1990 level. For

coal, petroleum, and electricity, there is

a drop in consumption from the reference

case to 7-percent-below-1990 levels

of 77.47 percent, 13.47 percent and

16.71 percent, respectively. Natural gas,

however, increases by 10.17 percent.

Even though total natural-gas usage in

the U.S. increases only 10.17 percent,

electric generators will see a very significant

increase in their natural-gas usage

under this Kyoto Protocol goal. Their

natural-gas usage from 1996 to 2005 will

increase 133 percent (or 4.06

quadrillion Btu), while from 2005 to

2010, it will increase 78.31 percent (or

5.56 quadrillion Btu), and from 2010 to

2020, it will increase 13.11 percent (or

1.66 quadrillion Btu). The critical question

is whether natural-gas capacity can

be built in sufficient quantity, if interstate

natural-gas pipelines can be built

on time, and if natural gas imports from

Canada and Mexico can support this

much expansion.

fuel consumption for the reference

case and the 7-percent-below-1990

level (on a Btu basis). One also can

compare the differences in fuel consumption

from the reference case to the

case of 7-percent-below-1990 level. For

coal, petroleum, and electricity, there is

a drop in consumption from the reference

case to 7-percent-below-1990 levels

of 77.47 percent, 13.47 percent and

16.71 percent, respectively. Natural gas,

however, increases by 10.17 percent.

Even though total natural-gas usage in

the U.S. increases only 10.17 percent,

electric generators will see a very significant

increase in their natural-gas usage

under this Kyoto Protocol goal. Their

natural-gas usage from 1996 to 2005 will

increase 133 percent (or 4.06

quadrillion Btu), while from 2005 to

2010, it will increase 78.31 percent (or

5.56 quadrillion Btu), and from 2010 to

2020, it will increase 13.11 percent (or

1.66 quadrillion Btu). The critical question

is whether natural-gas capacity can

be built in sufficient quantity, if interstate

natural-gas pipelines can be built

on time, and if natural gas imports from

Canada and Mexico can support this

much expansion.

Table 2 provides fuel-usage and CO2

emissions data for each of the fuel types

and CO2-emissions reductions from the

reference case and the case of 7-percent

below-1990 levels. To meet the 7- percent-

below-1990 goal, U.S. energy consumption would have to drop 19.51

quadrillion Btu in 2010—a 17.55-

percent reduction. Electric generators

created 9.96 quadrillion Btu per year of

the energy savings and remaining fuel

consumers created the other 9.55

quadrillion Btu per year. The reductions

in carbon emissions from electric generators

account for 68-percent of the total

CO2 emissions reduction, while the

remaining fuel consumers (residential,

commercial, industrial, and other)

account for 32 percent. The electric

generators accomplished the CO2 reductions through electricity-usage

reductions, generation efficiency, and

fuel switching.

reductions through electricity-usage

reductions, generation efficiency, and

fuel switching.

Kyoto Protocol Impact

Projected fuel and electricity prices in

the U. S. can be found in Table 3. The

data was taken from the EIA's Kyoto

Protocol study. Prices provided are actual

1996 prices, while projected prices

are for 2005, 2010, and 2020. All prices

are in 1996 dollars and costs (no escalation).

By providing the prices in 1996

dollars, one can see price variations that

occur without escalation variations.

Energy prices in the reference case

are fairly stable over the next 20 years.

Motor gasoline, distillate oil, and residual

oil show moderate price increases

through the year 2020. The Annual

Energy Outlook 2000 (AEO 2000)

prepared by the EIA illustrates slightly

higher prices than Table 3.

Coal prices are declining due to

gains in coal-mine labor productivity

and lower transportation costs. Natural-

gas prices are fairly stable over this

period, with most sectors experiencing

a slow increase in prices. Electricity

prices are dropping due to increased

competition, higher generating efficiencies,

and lower prices. The carbon

reduction target of 7-percent-below-

1990 reflects a "carbon price," which is

a tax that is applied to the cost of energy

intended to make carbon-rich fuels

financially untenable. In its report,

the EIA included projections based on

this tax at the request of Congress. The

carbon price that is applied to each of

the energy fuels is related to its carbon

content. With the carbon price included

in this delivered cost of energy,

energy prices are expected to rise significantly

above the reference-case

projections. Because of the higher carbon

content of coal and petroleum

products, the use of both fuels are reduced

and there is a greater reliance on

natural gas, renewable energy and nuclear

power. Coal is the most carbon

intensive of all the fossil fuels, therefore the delivered coal prices are most

affected by the carbon prices. As a result

of the carbon price, aggregate energy

prices in the U.S. will change significantly.

Table 3 provides energy-price projections

for the carbon-emissions-reduction

case of 7 percent below 1990

levels. It reveals that fuel prices increase

significantly, especially in 2010.

Coal prices are 867 percent higher

than the reference case , which is why

coal consumption drops by 80 percent

in that year (Figure 1). These changes

will have a significant negative impact

on coal industry, the railroads and

manufacturing that relies on coal. Regionally,

the price impact will be the

greatest in regions in which electricity

generation is currently dominated by

coal-fired power plants. Electricity

prices also increase significantly due to

higher fuel prices and capital investing

to replace coal-fired plants.

It is important to keep in mind that

the case of 7 percent below 1990 level

is the worst-case scenario (with respect

to fuel prices and emissions reductions),

which assumes that the

U.S. does not get any carbon-emission

credits for land-use forestry and agriculture,

existing programs to reduce

emissions of the other five greenhouse

gases, or for International Trade of

Carbon Permits. The Impact of the

Kyoto Protocol document prepared by

the EIA includes five less severe cases

(3 percent below 1990 levels, equal to

1990, 9 percent above 1990, 14 percent

above 1990, and 24 percent

above 1990). The energy prices in

each of these scenarios are less than

the figures in Table 3, but price increases

are still significant, even in

the most generous scenario: 24 percent

above 1990 levels. For example,

in the year 2010 under that scenario,

coal prices will have increased 156

percent above the reference case

while industrial natural gas will have

increased 33 percent and electricity

will have increased 24 percent.

Each case implicitly assumed different

levels of reductions for forestry and agriculture

sinks, reductions from five other

greenhouse gases, the international trading

of emissions permits, and other international

activities, which may offset the

required reductions of energy-related

carbon emissions.

U.S. Fuel Imports

When the oil embargo hit in 1973, almost 17 percent of the U.S.'s electricity

was generated by burning more

than 560,000,000 barrels of oil per

year. Today's utilities are less reliant

on oil. Only 3.8 percent of our electricity

is produced by burning

197,000,000 barrels per year. The

transportation sector, however, continues

to rely heavily on petroleum fuels.

In 1973, oil consumption was at

3,285,000,000 barrels per year; today,

it is more than 4,600,000,000 barrels

per year. The transportation sector accounts

for 66.7 percent of U.S. petroleum

consumption.

almost 17 percent of the U.S.'s electricity

was generated by burning more

than 560,000,000 barrels of oil per

year. Today's utilities are less reliant

on oil. Only 3.8 percent of our electricity

is produced by burning

197,000,000 barrels per year. The

transportation sector, however, continues

to rely heavily on petroleum fuels.

In 1973, oil consumption was at

3,285,000,000 barrels per year; today,

it is more than 4,600,000,000 barrels

per year. The transportation sector accounts

for 66.7 percent of U.S. petroleum

consumption.

Over the next two decades, imports

of natural gas and petroleum will continue

to rise. Under the reference case,

natural-gas imports will increase from

12 percent in 1996 to 17 percent in

2005 to 17 percent in 2010 and to 16

percent in 2020.2 Petroleum imports

will grow from 46 percent in 1996 to 60

percent in 2005 to 62 percent in 2010

and 64 percent in 2020.

During the 1970s, the decade of energy

crisis, OPEC members produced

about 50 percent of the world's daily

production and had control over petroleum

prices. Then in the 1980s,

OPEC production dropped to 33 percent

of the total world production.

However, in 2014 OPEC nations will

account for more than 50 percent of

total U.S. petroleum imports. By 2020,

OPEC once again will produce 50 percent

of the world's petroleum.

Nuclear Power

In 1998 nuclear power produced 674

billion killowatthours of electricity in

the U.S. Replacing that generation

with natural-gas combined-cycle gasturbine

generators will increase U.S.

CO2 emissions by 277 million tons per

year, which is 21 percent more CO2

emissions to remove in the year 2010.

Using coal-fired generation results in

633 million tons per year of CO2 emissions

or 48 percent more emissions to

be removed in 2010.

Because of disasters such as the Chernobyl

accident in 1986, nuclear power is

not a politically popular energy source.

However, eliminating nuclear power as

an energy source fuel will make the

goals of the Kyoto Protocol even more

difficult. If we allow our nuclear plants

to die off in the U.S., it will take 21-percent

additional natural gas to produce

the same amount of electricity. Using

coal-fired generation to replace nuclear

would result in a 30 percent increase in

coal consumption.

Nuclear plants produce electricity

without emitting greenhouse gases. Nuclear

power could also reduce our dependence

on imported energy. Two

countries that seem to support nuclear

power are China and Russia. China

plans to increase its nuclear generation

from 1.1 percent of its total to 18 percent

by 2020. Russia plans to more than

double its current 14 percent to 31 percent

by 2030.

World Fuel Resources

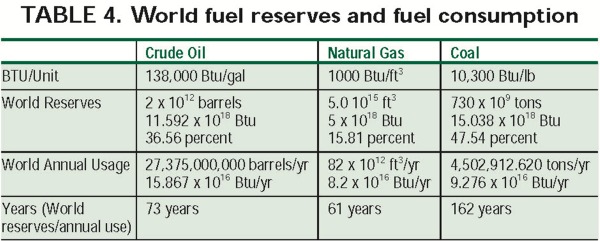

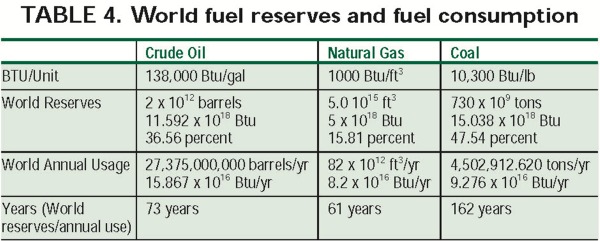

Table 4 is the author's attempt to

look at the world resources of our three

primary fuels and their usages. It is important

to note that coal constitutes almost

48 percent of the world fossil fuel

reserves. Also, at the current rate of petroleum

usage, some analysts think that

demand will begin to exceed supply in

25 years.

Conclusion

The Greenhouse effect, caused by

rising rates of CO2 and other gases, still

is debated by the experts. One central

concern is what fraction of the increase

in atmospheric CO2 levels is attributable

to humans and what fraction

is attributable to natural sources. Another

concern is the lack of conclusive

correlation between human-made

emissions and global warming. It's

likely that the U.S. Senate may have to

vote on the Kyoto Protocol before the

experts reach more conclusive results.

The primary aim of this article was

to raise the level of understanding of

energy, technology, the environment,

resource availability, and the economy.

The intent was to provide the reader

with an appreciation of all these issues

so that we as a society can make equitable

decisions in the years ahead. The

author's advice to designers, installers

and maintenance people is to stay informed

on the issues of environmental

legislation in particular the Kyoto Protocol,

and to choose more efficient

equipment, which not only saves on

annual fuel costs, but also reduces our

air emissions and our dependence on

imported energy. One easy way to do

this would be to consider renewable

energy systems or to purchase electricity

made from renewable energy

sources. There is no single answer to

the questions about energy in the years

ahead, but you can be sure that there

will be environmental challenges and

probably be energy crises as well.

[ back to top ]

References

1. "Impacts of the Kyoto Protocol on

U.S. Energy Markets and Economic Activity."

Energy Information Administration,

1998.

2. "Annual Energy Outlook, 2000."

Energy Information Administration.

|

|

The electric-power industry in the

United States is composed of traditional

electric utilities as well as power

marketers and non-utility power producers.

Currently, the industry is being

restructured so that the three primary

components of electric service—generation,

transmission, and distribution—

are separated. Instead of purchasing

power from the local utility,

consumers will be able to purchase

from other generators across the U.S.

Proposed legislation will deregulate the

generation part of the industry; however,

transmission and distribution

utilities will continue to be controlled

by state regulatory commissions. This

section of the article will review the

costs that makeup the total delivered

cost of electricity (Busbar cost) for

each generation system technology.

The author chose to review total costs

so that the data could be compared to

data from the EIA (1998 Electric

Power Annual, Vol. 1; 1997 Electric

Power Annual, Vol. 2; Financial

Statistics of Major U.S. Investorowned

Electric Utilities, 1996; Electric

Sales and Revenue, 1997; Emissions of

Greenhouse Gases in the U.S., 1998;

and Annual Energy Outlook 2000).

The electric-power industry in the

United States is composed of traditional

electric utilities as well as power

marketers and non-utility power producers.

Currently, the industry is being

restructured so that the three primary

components of electric service—generation,

transmission, and distribution—

are separated. Instead of purchasing

power from the local utility,

consumers will be able to purchase

from other generators across the U.S.

Proposed legislation will deregulate the

generation part of the industry; however,

transmission and distribution

utilities will continue to be controlled

by state regulatory commissions. This

section of the article will review the

costs that makeup the total delivered

cost of electricity (Busbar cost) for

each generation system technology.

The author chose to review total costs

so that the data could be compared to

data from the EIA (1998 Electric

Power Annual, Vol. 1; 1997 Electric

Power Annual, Vol. 2; Financial

Statistics of Major U.S. Investorowned

Electric Utilities, 1996; Electric

Sales and Revenue, 1997; Emissions of

Greenhouse Gases in the U.S., 1998;

and Annual Energy Outlook 2000).

The average age of coal-fired systems

in the U.S. is approximately 41 years,

hydro is 54 years, oil steam is 31 years,

natural gas is 30 years and nuclear is 18

years. The gas-turbine system represented

in Table 1 would be a fairly young

plant. The prices are 1997 costs per KWH.

The low-cost producer in this table is hydroelectric

at 4.72 cents per KWH followed

by coal steam at 5.72 cents per

KWH. Due to limited resources, hydroelectric

power is not the predominant

technology in the U.S. It is coal steam,

which produces over 55 percent of our

electricity. Due to upcoming environmental

pressures, coal usage will decrease

over the next 20 years. The degree

to which it decreases is subject to

debate. According to the EIA's Annual

Energy Outlook, coal usage will continue

to increase, but lose market share

over the next two decades.

The average age of coal-fired systems

in the U.S. is approximately 41 years,

hydro is 54 years, oil steam is 31 years,

natural gas is 30 years and nuclear is 18

years. The gas-turbine system represented

in Table 1 would be a fairly young

plant. The prices are 1997 costs per KWH.

The low-cost producer in this table is hydroelectric

at 4.72 cents per KWH followed

by coal steam at 5.72 cents per

KWH. Due to limited resources, hydroelectric

power is not the predominant

technology in the U.S. It is coal steam,

which produces over 55 percent of our

electricity. Due to upcoming environmental

pressures, coal usage will decrease

over the next 20 years. The degree

to which it decreases is subject to

debate. According to the EIA's Annual

Energy Outlook, coal usage will continue

to increase, but lose market share

over the next two decades. The average revenue in cents per KWH is

calculated by dividing the total revenue

by the corresponding KWH sales for each

sector (residential, commercial, industrial,

and other) and from all generation

technologies in that state. To compare

the Busbar cost of each technology, it

was important to look at states that had

high percentages of electricity generation

for that technology. The numbers

in the two tables seem to compare

rather favorably to Table 1 data except

for nuclear. After further review the author

did find somewhat high costs from

sales for resale that could be adding as

much as a cent per KWH. According to

data from the Nuclear Energy Institute

(NEI) on operations, maintenance and

fuel, there is a 1.6 cent/KWH variation

from low -cost plants to high-cost

plants. At this point, it is difficult to say

exactly how much of the added cost (2.8

to 3.50 cents per KWH) is from nuclear

plants and how much might be from

other technologies, sales for resale, and

outside contracts.

The average revenue in cents per KWH is

calculated by dividing the total revenue

by the corresponding KWH sales for each

sector (residential, commercial, industrial,

and other) and from all generation

technologies in that state. To compare

the Busbar cost of each technology, it

was important to look at states that had

high percentages of electricity generation

for that technology. The numbers

in the two tables seem to compare

rather favorably to Table 1 data except

for nuclear. After further review the author

did find somewhat high costs from

sales for resale that could be adding as

much as a cent per KWH. According to

data from the Nuclear Energy Institute

(NEI) on operations, maintenance and

fuel, there is a 1.6 cent/KWH variation

from low -cost plants to high-cost

plants. At this point, it is difficult to say

exactly how much of the added cost (2.8

to 3.50 cents per KWH) is from nuclear

plants and how much might be from

other technologies, sales for resale, and

outside contracts.

Change," which was held in Kyoto, Japan,

in December 1997. During that

meeting, representatives from more

than 160 countries met to negotiate

binding limits on greenhouse-gas emissions

for developed nations.

Change," which was held in Kyoto, Japan,

in December 1997. During that

meeting, representatives from more

than 160 countries met to negotiate

binding limits on greenhouse-gas emissions

for developed nations.

By 2010 (mid-year of the Kyoto commitment

period), the reference case

emissions are 43 percent above the 7-

percent-below 1990 emissions, which

is 2,177,804,514 tons of CO2 over the

target of 5,059,448,673 tons of CO2.

By 2010 (mid-year of the Kyoto commitment

period), the reference case

emissions are 43 percent above the 7-

percent-below 1990 emissions, which

is 2,177,804,514 tons of CO2 over the

target of 5,059,448,673 tons of CO2.

fuel consumption for the reference

case and the 7-percent-below-1990

level (on a Btu basis). One also can

compare the differences in fuel consumption

from the reference case to the

case of 7-percent-below-1990 level. For

coal, petroleum, and electricity, there is

a drop in consumption from the reference

case to 7-percent-below-1990 levels

of 77.47 percent, 13.47 percent and

16.71 percent, respectively. Natural gas,

however, increases by 10.17 percent.

Even though total natural-gas usage in

the U.S. increases only 10.17 percent,

electric generators will see a very significant

increase in their natural-gas usage

under this Kyoto Protocol goal. Their

natural-gas usage from 1996 to 2005 will

increase 133 percent (or 4.06

quadrillion Btu), while from 2005 to

2010, it will increase 78.31 percent (or

5.56 quadrillion Btu), and from 2010 to

2020, it will increase 13.11 percent (or

1.66 quadrillion Btu). The critical question

is whether natural-gas capacity can

be built in sufficient quantity, if interstate

natural-gas pipelines can be built

on time, and if natural gas imports from

Canada and Mexico can support this

much expansion.

fuel consumption for the reference

case and the 7-percent-below-1990

level (on a Btu basis). One also can

compare the differences in fuel consumption

from the reference case to the

case of 7-percent-below-1990 level. For

coal, petroleum, and electricity, there is

a drop in consumption from the reference

case to 7-percent-below-1990 levels

of 77.47 percent, 13.47 percent and

16.71 percent, respectively. Natural gas,

however, increases by 10.17 percent.

Even though total natural-gas usage in

the U.S. increases only 10.17 percent,

electric generators will see a very significant

increase in their natural-gas usage

under this Kyoto Protocol goal. Their

natural-gas usage from 1996 to 2005 will

increase 133 percent (or 4.06

quadrillion Btu), while from 2005 to

2010, it will increase 78.31 percent (or

5.56 quadrillion Btu), and from 2010 to

2020, it will increase 13.11 percent (or

1.66 quadrillion Btu). The critical question

is whether natural-gas capacity can

be built in sufficient quantity, if interstate

natural-gas pipelines can be built

on time, and if natural gas imports from

Canada and Mexico can support this

much expansion. reductions through electricity-usage

reductions, generation efficiency, and

fuel switching.

reductions through electricity-usage

reductions, generation efficiency, and

fuel switching.

almost 17 percent of the U.S.'s electricity

was generated by burning more

than 560,000,000 barrels of oil per

year. Today's utilities are less reliant

on oil. Only 3.8 percent of our electricity

is produced by burning

197,000,000 barrels per year. The

transportation sector, however, continues

to rely heavily on petroleum fuels.

In 1973, oil consumption was at

3,285,000,000 barrels per year; today,

it is more than 4,600,000,000 barrels

per year. The transportation sector accounts

for 66.7 percent of U.S. petroleum

consumption.

almost 17 percent of the U.S.'s electricity

was generated by burning more

than 560,000,000 barrels of oil per

year. Today's utilities are less reliant

on oil. Only 3.8 percent of our electricity

is produced by burning

197,000,000 barrels per year. The

transportation sector, however, continues

to rely heavily on petroleum fuels.

In 1973, oil consumption was at

3,285,000,000 barrels per year; today,

it is more than 4,600,000,000 barrels

per year. The transportation sector accounts

for 66.7 percent of U.S. petroleum

consumption.